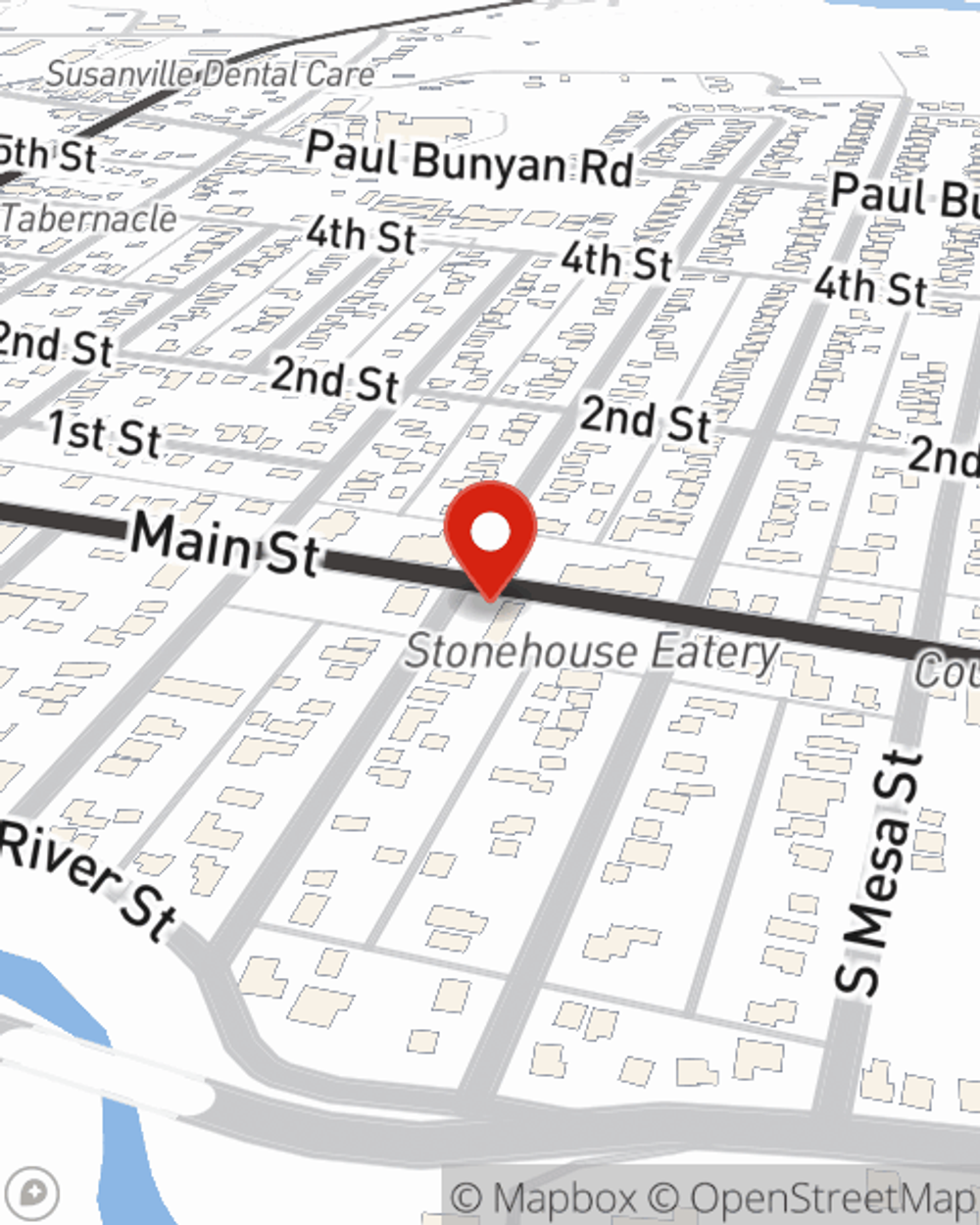

Homeowners Insurance in and around Susanville

Protect what's important from the unanticipated.

Help cover your home

Would you like to create a personalized homeowners quote?

- Boise, ID

- Meridian, ID

- Idaho

- Nevada

- California

- Star, ID

- Eagle, ID

- Kuna, ID

- Reno, NV

- Carson City, NV

- Sparks, NV

- Las Vegas, NV

- Henderson, NV

- Coeur d’Alene, ID

- Middleton, ID

- Nampa, ID

- Twin Falls, ID

- Idaho Falls, ID

- Pocatello, ID

- Hayden, ID

- Fallon, NV

- Fernley, NV

- Elko, NV

- Mesquite, NV

There’s No Place Like Home

There's truly no place like home. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, the trusted name for homeowners insurance. State Farm Agent Brian Wilson is your caring authority who can offer an insurance policy personalized for your unique needs.

Protect what's important from the unanticipated.

Help cover your home

Agent Brian Wilson, At Your Service

Brian Wilson can walk you through the whole coverage process, step by step. You can have a straightforward experience to get an insurance policy for everything that’s meaningful to you. We’re talking about more than just protection for your appliances, furnishings and home gadgets. Protect your family keepsakes—like mementos and collectibles. Protect your hobbies and interests—like tools and musical instruments. And Agent Brian Wilson can share more information about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or choose a higher deductible, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

Whether you're prepared for it or not, the unexpected can happen. But with State Farm, you're always prepared, so you can unwind knowing that your belongings are safe. Additionally, if you also insure your auto, you could bundle and save! Contact agent Brian Wilson today to go over your options.

Have More Questions About Homeowners Insurance?

Call Brian at (530) 257-5189 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Understanding landslides and mudslides

Understanding landslides and mudslides

Read about the different characteristics between landslides and mudslides and learn what can be done to help prevent them.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.

Brian Wilson

State Farm® Insurance AgentSimple Insights®

Understanding landslides and mudslides

Understanding landslides and mudslides

Read about the different characteristics between landslides and mudslides and learn what can be done to help prevent them.

Home warranties

Home warranties

Learn here about what home warranties are, what they cover, and how they might offer added protection.